Have you ever made a payment using your mobile phone? Chances are you have: a recent BBC report found that half of UK adults now do. Contactless payments using Apple Pay, rather than a tap of a card, are fast becoming the default for millions of customers when making in-person payments.

But what if we told you that mobile phones have much more potential for making payments? In a way that doesn’t require a well-placed terminal that can be tapped on, but instead can be processed fully remotely.

This is the promise that Payment Links delivers, making it easy to send payment details over SMS or email and receive payment instantly. You wanted faster, more convenient payments; you’ve got them.

So, what are Payment Links?

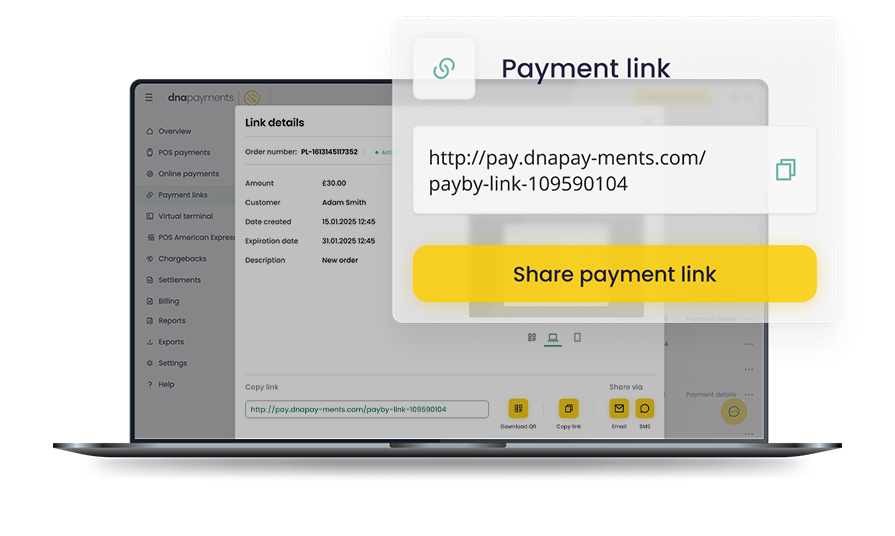

Ultimately, Payment Links do what they say on the tin. They’re a unique URL that, when clicked on by a customer, takes them to an online portal where they can securely complete a payment. That can be a regular URL if you’re sending the link via email or SMS, or it can be a QR code if you want customers to scan it with their phone.

The beauty of this payment type lies in its flexibility, eliminating the need for complex payment systems or a website payment portal; additionally, zero development and coding are required to set it up.

Additionally, if your business uses invoicing or accounting software, you can embed a Payment Link as a quick pay button in your PDF invoices, potentially shortening payment terms.

All Payment Links are managed through your Merchant Portal, and once you’re set up with your portal access, you can easily log in to create Payment Links, plus monitor the status once sent, giving you complete visibility right through to your final Settlements and billing.

What’s new with Payment Links?

We’ve rolled out some exciting improvements to make Payment Links even more beneficial. Most recently, we’ve added new multi-use and reusable links, allowing the same link to be used for multiple payments without the need to repeatedly visit the Portal. You can use either the one-time option for ad hoc links or the multi-use option for links that can be reused for fixed price services or products.

With the new QR Code generator, download your code as a PDF from your Merchant Portal and display it anywhere customers need to pay using their mobile device, or have it added to your PDF, or paper invoices. This solution suits brick-and-mortar, on-location, and on-the-go businesses that want to accept quick payments for bookings, events, and other services. It allows customers to conveniently complete payments on the spot, directly from their mobile devices, ensuring a smooth and efficient transaction process.

Customers can then choose their preferred card or have their details filled in automatically using wallets like Google Pay or Apple Pay. Support also includes all major card schemes, ensuring we have you covered regardless of your customer's preferred payment method.

Why not try it for your business?

Ready to simplify payments and boost your business? Contact us here to get started with Payment Links - our team is here to help you unlock the full potential of mobile-powered payments.